Fill in W-9 tax form and securely sign it using DocuSign

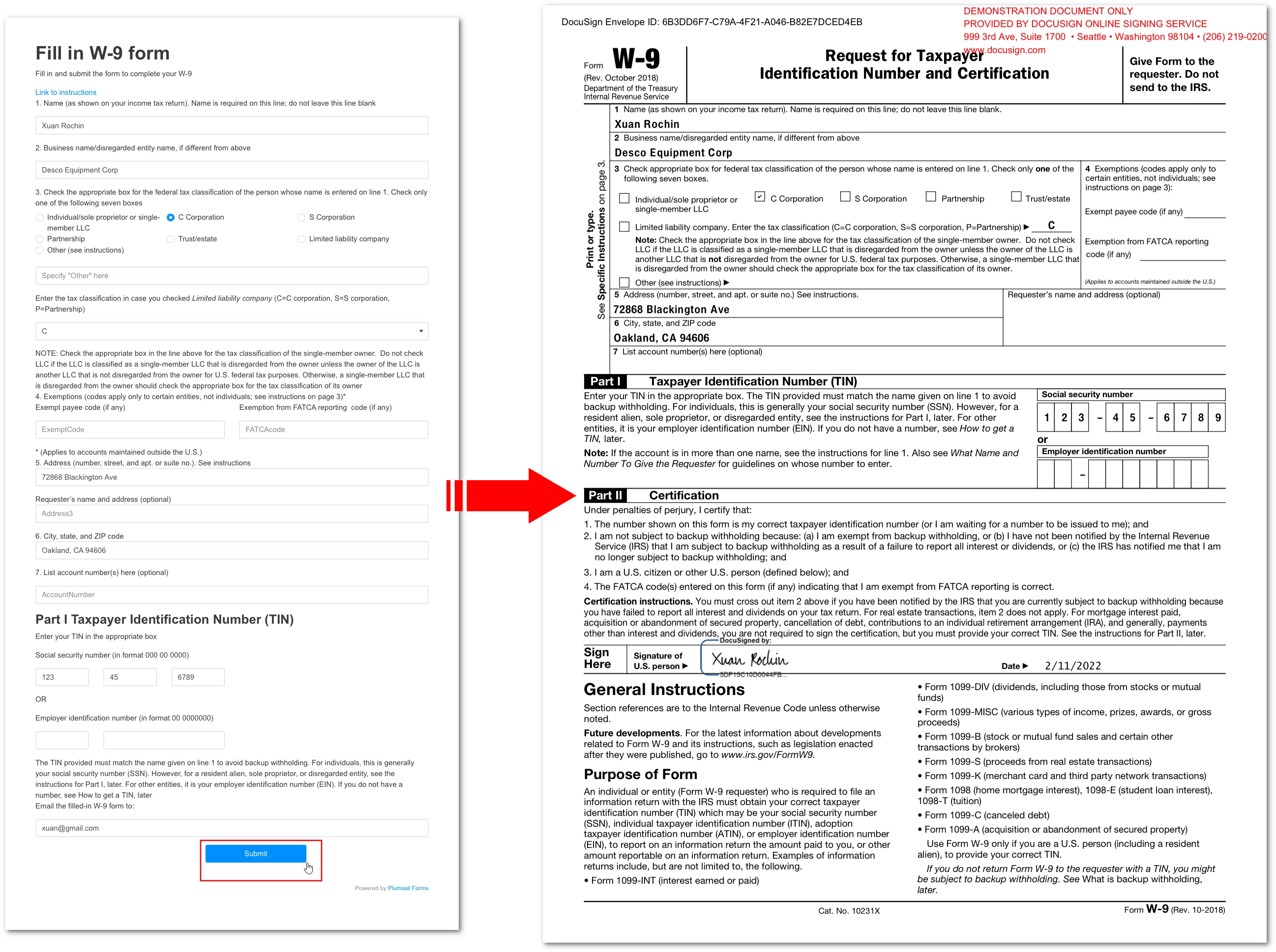

Dealing with different contractors or freelancers requires you to collect the IRS W-9 tax form filled in and signed by them. You may want to automate the bureaucracy routine and make the process transparent, fast, and convenient. Plumsail Documents can help you with this. It provides a ready-to-use web form. After the contractor submits it, you get a filled and signed PDF document:

In this article, we will describe a sample case with the DocuSign service. All you need is to perform three steps:

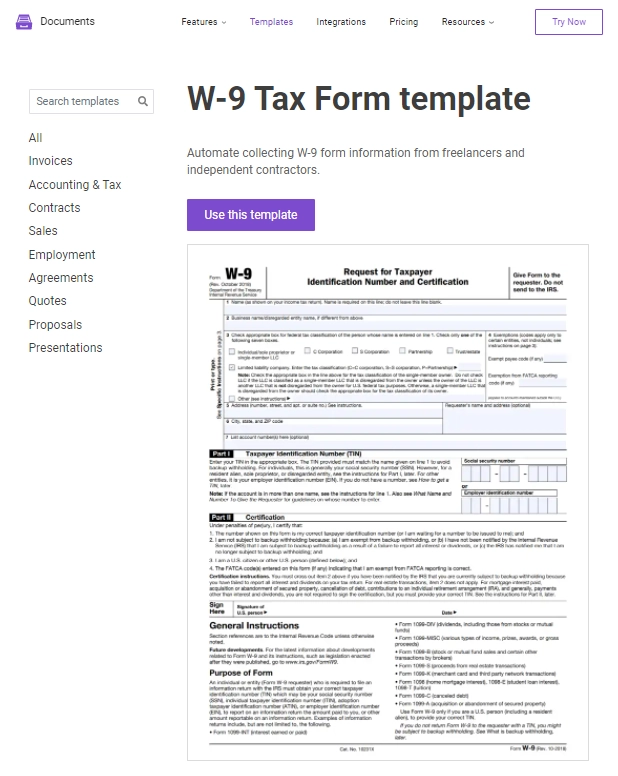

Get the template

Choose the W-9 form in Plumsail templates and click the Use this template button.

Set the process name and switch the toggle to create a rich web form.

Plumsail Documents provides multiple deliveries. In this example, we use the DocuSign delivery as a sample but you can choose another service provider and prepare the template accordantly.

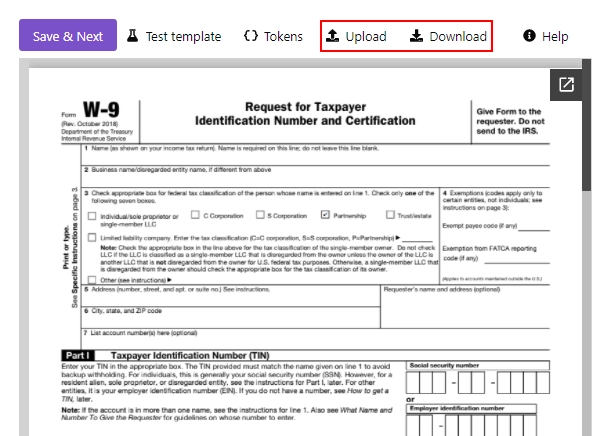

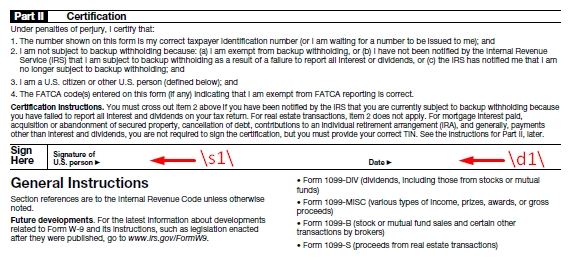

The form does not contain tags for DocuSign to indicate places for a signature and date (\s1\ and \d1\ respectively).

Download the template, add the tags to it and upload the file back to the process.

For hiding, color the tags white.

The delivery itself is described below.

Once you are finished with the template, click Save & Next.

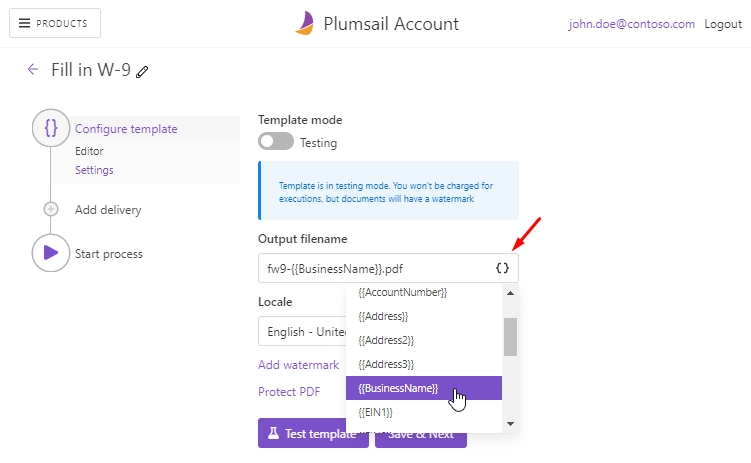

In the Settings of the resulting file, add a token to the file name to use the data from the filled form and distinguish the result files. Click Save & Next.

Use e-signature

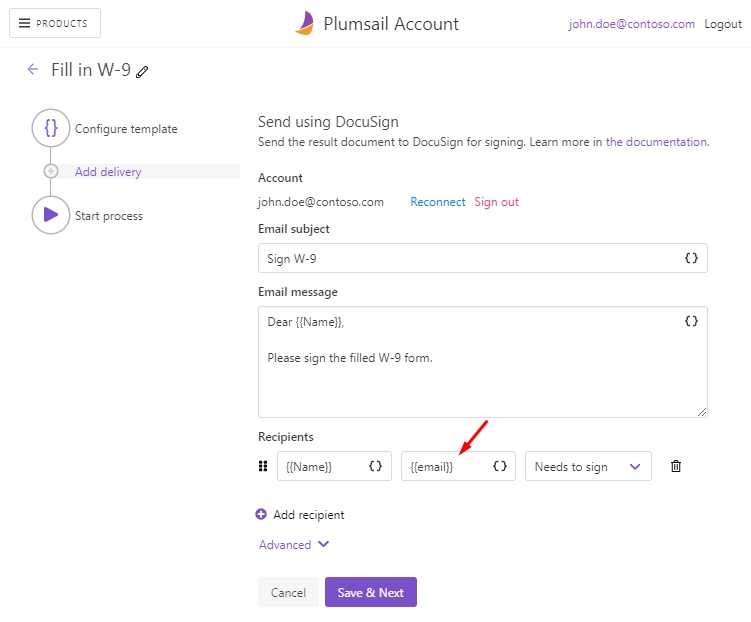

Add a DocuSign delivery or any other for e-signing.

In this step, you can use the information dynamically both from the PDF form and the web form bound with the process.

It is available through tokens that you can find in the drop-down list on clicking { }.

They will be replaced by unique values based on each submission.

The web form contains an email field, so I added an accordant token to the delivery.

Click Save & Next.

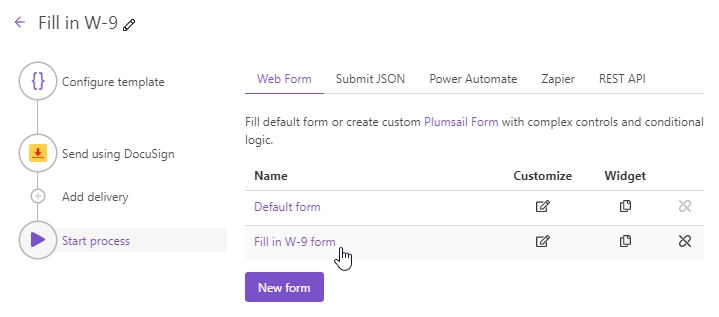

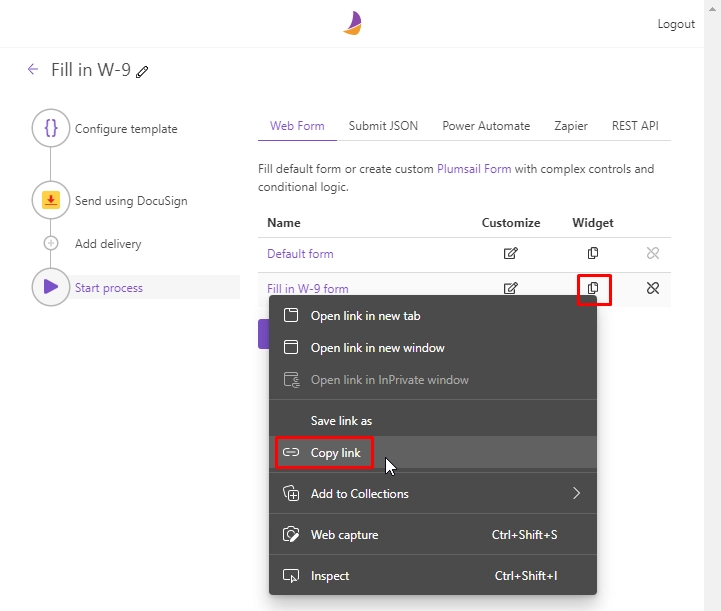

Use web form

The rich form mentioned in the beginning will have the same name as the process with a “form” suffix.

You can share a link to the form or copy it as an HTML widget and embed it onto your site.

Provide your contractors with access to the form in either way. Submission of the filled form will start the process and generate a PDF file. Then, it will send a link to the contractors for signing the W-9 form in DocuSign. The signed documents will be available in your DocuSign account.